Are you serious about growing your HVAC business? If so, it may be time to consider mergers and acquisitions (M&As) as a growth strategy.

But why wouldn’t you double down on growing your HVAC company organically instead?

For one simple reason. Organic business growth, while healthy and ultimately effective, can be slow. Buying an HVAC business and merging it with your existing company gives you a huge leap forward. You’ll have more techs, more customers, and more opportunities immediately.

At a cost, of course.

So the question is, would buying an existing HVAC company be the right move for your business? In this article, we’ll will help you make that determination.

We’ll covers everything you need to know about buying an HVAC business, including:

- Why acquiring another HVAC company is a great idea

- What it takes to buy an HVAC business

- How to value an HVAC company to ensure you get a good deal

- Where to source funds for business acquisition

- The mistakes to avoid when buying an HVAC business

Let’s dive in.

FROM ONE OF OUR PARTNERS: How to Scale Your HVAC Business

Why HVAC Companies Make a Great Acquisition Option

Why would you want to acquire another HVAC business? After all, you have your own HVAC company to run.

Buying a new HVAC business is a weighty decision with far-reaching implications. So, it should be done for all the right reasons. To that end, here’s why you should consider buying an HVAC business.

Widen Your HVAC Customer Base

Small and medium-sized HVAC businesses operate within specific geographical regions. Many HVAC companies serve particular towns or zip codes. And just one HVAC contractor may completely dominate their service area.

This means it can be difficult to branch out and penetrate new markets outside your brand’s sphere of influence.

However, acquiring an existing HVAC company gives you access to its customer base and prospects. This is arguably the best thing about buying a business.

In fact, it’s one of the main reasons why entrepreneurs buy businesses similar to their own.

Gain Access to Quality HVAC Talent

Qualified and dependable talent is hard to come by. And it’s not just a problem for the HVAC industry. The entire country is facing a historic labor crisis.

With less than 50% filled job positions, professional and business services are among the hardest-hit labor sectors.

Are you having trouble finding or retaining skilled HVAC technicians? Buying a fully-staffed HVAC business increases the size of your workforce immediately.

You’ll need to incorporate the new crew into your existing business, which may require some company-specific training and some time. However, the incoming workers won’t need job-related training as they’re already doing the job. That’s a huge plus.

RELATED ARTICLE: How to Attract and Retain the Best HVAC Employees

Access Additional HVAC Assets

In most cases, when you buy a business all its assets are included in the price.

Depending on the wealth of the HVAC business you choose to buy, you may end up acquiring valuable resources such as:

- Business premises (offices, storage units, crew dispatch stations, etc.)

- Vehicles

- HVAC tools and equipment

- Consumable inventory (HVAC units and spare parts)

- Crew kits and work gear

- Ongoing HVAC jobs or projects

- Digital assets (business management software, marketing platforms, social media accounts, etc.)

FROM ONE OF OUR PARTNERS: The Complete Guide for HVAC Software

Diversify Your Service Portfolio

If your business provides only specialized HVAC services, an acquisition might be a great way to diversify your service offerings.

For instance, if you specialize in air conditioning, buying a heating and cooling company would round out your HVAC business.

Buying an existing HVAC company may provide the expertise, resources, and clientele needed to expand your service scope.

Fresh Ideas and New Perspective

Buying another HVAC business makes you uniquely able to study a rival brand. You might learn a thing or two about how to run a successful HVAC business.

Plus, employees from the other business might open your eyes to helpful new ideas.

Also, you get to examine the business you’re buying from an outsider’s vantage point. As a successful HVAC business owner yourself, you’ll easily identify the business’s flaws and strengths.

You’ll know exactly what you’re getting out of the deal and how to make the most of it.

What’s the Process of Buying an HVAC Business?

There’s more to acquiring an existing HVAC business than just finding a listing, putting down an offer, and shaking on it. For one, the purchase process requires a lot of due diligence.

Moreover, acquisitions have lots of moving parts. And no two deals are alike.

Did you know that up to 90% of potential small business acquisition deals fail? They fail because most buyers are first-timers who know little about buying businesses.

But don’t worry if you’re a first-time business buyer. Here’s a simple 6-step guide to successfully buying an HVAC business:

1. Find an HVAC Business Worth Buying

The first step is shopping around for an HVAC business. Ask yourself why you want to buy an HVAC business in the first place. Then find a business that matches your needs and expectations.

Look for a business that would make for a strategic purchase, one primed for profitability and growth.

While there’s no “perfect business,” the HVAC company you purchase should at least check most of the following boxes:

- Positive cash flow

- Prime location and service area

- Diverse customer base

- Skilled workers

- Wide range of HVAC services

- Valuable HVAC resources

- Positive growth trajectory

- Good reputation for HVAC services delivery

Look in as many places as possible to find that gem. Ask your local business brokers and HVAC business owners about potential acquisitions.

You can also search HVAC listings on broker sites, such as bizbuysell.com.

2. Negotiate the Purchase

Once you find an affordable HVAC business that ticks all the boxes, contact the seller or broker for a negotiation. Grab the seller’s attention by making a non-binding offer close to the asking price.

At the negotiation table, check whether the business is all it’s made up to be. Also, the business owner will likely provide documentation to support their ask, which you can counter.

Expect a lot of back and forth in the acquisition dialog. You’ll likely go over several price points and terms before reaching a tentative agreement.

3. Make an Offer

If the business seems like a reasonable purchase, you can go ahead and put down an offer. This is typically done through a letter of intent (LOI).

A letter of intent is a non-binding agreement expressing your intentions to proceed with the deal. It also highlights everything you previously discussed at the negotiation table, including the price and terms of purchase.

A letter of intent gives you exclusive rights to purchase the business, typically within 90 days. That’s plenty of time to conduct due diligence, weigh your options, and source funds.

4. Conduct Due Diligence

Having signed the LOI, the seller is obligated to provide you with all the documents needed to evaluate the business.

You’ll want to look at the following documents to determine the business’s performance and posture:

- Business identification, merit, and licensing documents

- Current financial records such as cash flow statements, profit and loss statements, balance sheets, and bank statements

- Tax returns over the last three years

- Open HVAC contracts, jobs, or projects

- HVAC client lists

- Marketing and advertising materials

- Employee profiles and work history

- List of assets/properties, including leases, inventory, and pending purchases

- Documentation of existing debts (if any)

- Past and current litigation (if any)

The LOI buys you time and information to critically analyze the HVAC business in order to reach a purchase decision. Should you find any red flags at this stage, you have the right to pull out of the deal.

5. Arrange Financing

If everything checks out, you can start sourcing funds to close the deal.

You could tap into your savings or liquidate an asset to raise the cash. And if none of these are feasible routes, you can always take out a loan.

Provided your business has strong credit, you’ll have lots of financing options. Check your eligibility for SBA loans, asset/equity-based financing, business acquisition loans, or term loans.

The important thing is to choose a financing option with favorable and manageable terms.

6. Close the Deal

Once you’re satisfied with the business and have the necessary financing, there’s nothing left but to close the deal.

Draft an agreement with the seller to finalize the sale. The purchase agreement should include every detail of the sale, from the price and payment terms to the liabilities and assets involved.

Once both parties sign on the dotted line and the money changes hands, it’s a done trade.

You’re now the owner of another HVAC company. And it’s up to you to decide what to do with it. For instance, you could absorb the new company into your own or run it as an affiliate under its existing brand.

How Do You Value an HVAC Business?

When buying a company, it’s essential to know its value. Otherwise, how will you tell if the price is right?

However, determining the actual value of a private company is a complex task.

The most basic way to calculate the value of an HVAC company is by subtracting its liabilities from its assets. Doing so gives you the “enterprise value,” which paints only a partial picture of the business’s worth.

You have to look at valuation from every possible angle.

Here are 5 key factors to consider when evaluating an HVAC business with the intention of acquiring it.

EBITDA

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. It’s a common valuation metric that measures a company’s financial health and earning performance.

A company’s net profits are not always a clear indicator of financial performance. In most cases, profits give an unclear, biased, or incomplete representation of a company’s financial muscle.

EBITDA measures a business’s core profitability after stripping away factors that are beyond the company’s control.

The larger the EBITDA, the more valuable the enterprise.

FROM ONE OF OUR PARTNERS: The 8 “P’s” to Maintaining a Profitable Business

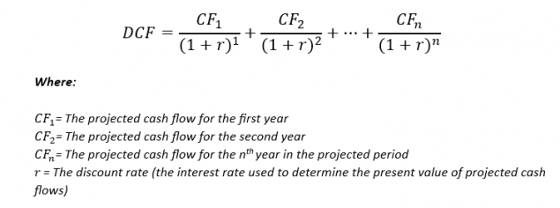

Discounted Cash Flows (DCF)

This is a common valuation method used to estimate the value of a business based on its expected future cash flows. DCF essentially determines the present value of projected cash flows.

It’s calculated using this formula:

If the DCF exceeds the cost of buying the HVAC company, consider the purchase a worthwhile investment.

Customer Concentration

Customer concentration measures revenue generation across a company’s customer base.

A business is said to have high customer concentration when a single customer accounts for 10% or more of its revenue or when its largest five customers account for 25% or more of its revenue.

A concentrated customer base means only a few customers keep the business going. That’s a huge red flag, which translates to a lower valuation.

Growth Potential

An HVAC business, especially a startup, may not post impressive performance figures. But if it makes up for poor performance in growth potential, it’s a valuable company, even if it doesn’t say so on paper.

Spotting these diamonds in the rough takes a keen entrepreneur’s eye. It may be a mismanaged HVAC company, a budding startup yet to spread its wings, or a prime business that isn’t living up to its potential.

Competitive and Complementary Advantages

A company’s value can be subjective. How valuable would the acquisition be in terms of sharpening your competitive edge or complementing your existing HVAC enterprise?

You can measure, to some degree of accuracy, how much buying the HVAC business could improve your competitiveness, market influence, and service delivery. That figure becomes part of the company’s value, though it only counts from your perspective.

How to Finance an HVAC Business Acquisition

Price tags for small to medium-sized HVAC businesses lie in the five to six-figure range. That’s probably not the kind of money you’d have lying around. So, acquisition financing might be the only way to raise enough cash to buy another HVAC company.

Here are 5 common acquisition financing options available to you:

- Bank financing. With bank financing, you’ll be looking at lines of credit, term loans, or dedicated business acquisition loans. These are typically secured with high-value assets or company equity.

- Earnout. This is more of a payment arrangement between you and the seller. You make a downpayment of, say, 30% of the asking price and pay the remainder in annual or monthly installments from the revenue generated by the business.

- Leveraged buyout. In this arrangement, you make a small upfront commitment and fund the rest of the cost using debt secured against the assets of the business being purchased.

- SBA loan. The US Small Business Administration offers a selection of SMB loans under the 7(a) program. You can borrow up to $5 million if your business qualifies for SBA financing.

- Third-party financing. This involves turning to non-institutional or alternative lenders for financing. For instance, you could request friends and family, business associates, investors, or business welfare organizations to fund your acquisition venture.

Avoid These 5 Mistakes When Buying an HVAC Business

If done properly, buying an HVAC business can be highly rewarding. But it’s a risky endeavor that can quickly turn into a sour investment. You can’t afford any blunders when taking such a big step.

Avoid these 5 rookie mistakes entrepreneurs make when buying a business.

Taking the Seller’s Word for It

Some sellers exaggerate their profit figures, while others hide their company’s true status under misleading jargon and heavy marketing.

So, take everything the seller says with a grain of salt. Verify every fact about the business yourself, especially the financial figures.

Rushing to Close the Deal

Buying a new business can be exciting. But don’t let the excitement overwhelm you or cloud your better judgment. Take your time and conduct thorough due diligence. Do not close the deal until you’re completely satisfied with the decision.

Also, do not let the seller or business brokers pressure you to take action. A rush acquisition deal is never a good sign. The seller is probably trying to hide something.

Signing an Un-Favorable Purchase Agreement

Ensure the final agreement matches exactly what you discussed with the seller. Also, ensure you understand what every clause in the agreement means, not just for the purchase but also for the longevity of the investment.

Again, take your time. Read the contract thoroughly to see if anything is a miss. Have your attorney or business associates read through the document too.

You can never be too cautious.

Remember, there’s no going back once you sign on the dotted line.

Buying for the Wrong Reasons

Why do you want to buy an HVAC business? Buying a new business is not something you do every day. You must have a good reason for going through with it.

If you’re struggling to justify the purchase, you’re probably making it for the wrong reasons. Don’t buy an HVAC business just because you can—that’s how people make bad investments.

Instead, carefully weigh all the pros and cons of buying the business. More importantly, think about what comes after the purchase.

Having Unrealistic Expectations

Optimism is a good look on an entrepreneur. But try not to be overly confident in your investments. Keep all your expectations and ambitions firmly grounded in reality.

For example, don’t exaggerate the growth potential of the business you intend to buy. If you do, it will give you the wrong impression of the business, and you may end up overpaying for a regretful investment.

Balance your optimism with facts and figures. Keep one eye on “what could be” and the other eye on the numbers.

RELATED ARTICLE: Keep Your Service Technicians Motivated with These 6 Tips

Related Posts

Stay Informed

Get the latest news and insights plus, Service Fusion offers and updates.Thank you for your submission.

SHARE